John Hughes-Wilson and his literary agent, Andrew Hayward at Court Publishing Services, are developing a dynamic, multimedia, freemium product under the auspices of the Guild of Battlefield Guides (of which the author is a past President) called Compendium to Military History.

Some taster content will be free, like this blog post; whereas access to detailed content – including audio and video clips – will be paid for via a cheap, monthly subscription.

For more details about how to subscribe to the full Compendium to Military History project, please send your name and email address to Andrew Hayward at: andrew.hayward21@yahoo.com

Introduction

Military history continues to fascinate.

Indeed, at a time when, certainly in the West, fewer and fewer people have actually served in the armed forces, the subject seems to have actually grown in popularity. As Dr Johnson pointed out, ‘No man [and increasingly it would now appear, some women] but thinks meanly of himself for not having been a soldier.’

However, that alone doesn’t account for our fascination with war. The real truth may lie much deeper, in our uncomfortable realisation that war and conflict are really an inbuilt part of our make-up. Fighting and war has always been humanity’s darkest group activity.

This book doesn’t seek to glorify war. On the contrary, it records many of the horrors of war. But over thirty years of soldiering – plus over 150 battlefield tours – have taught me that war and soldiering are not all bad. Soldiering can be rich in the finer things of life, too: comradeship; comedy; heroes and idiots; eccentrics; self-sacrifice and endurance; good and bad luck; sometimes even a sense of being a better person, or serving a greater cause. But, above all, humour: my old sergeant major used to say that if he didn’t get three good laughs a day out of the army, he’d quit. He soldiered on and took his pension.

This may partly explain the interest in a subject devoted to what is otherwise really just a long and dismal record of breaking things and hurting people – because that’s what war is.

So, this compendium of facts and stories seeks to entertain as much as educate, while guiding the reader down the long path of things martial from the dawn of time. It’s part of what we do as a species, whether we like to admit that truth or not.

I have arranged it as a series of crisp little ‘factoids’, little stories that I hope will interest and entertain. It tries to follow a chronological trail, covering the whole sweep of military history. That’s an impossible task; but at least our selection is not all about the West. For example, the Chinese invented – and used – gunpowder long before Roger Bacon and his fellow monks wrote about it. And the Koreans had a fighting ironclad in the water long before the Europeans ‘invented’ one. That means that the scope is global, which makes the subject a huge field. So, although I have tried to highlight the little known and the unusual as much as possible, the range of possible entries is so great that sometimes it’s been hard to pick out the best stories.

The result is that some of the entries are serious, some are grim and some are just plain daft, because I have to confess to occasionally being drawn to the odd and eccentric. Maybe that’s a reflection of the fact that wars are fought by real people, and real people sometimes behave very oddly indeed. Who, for example, could believe that one successful general, not so long ago, was given to walking around stark naked with an alarm clock tied round his neck while munching a raw onion? But he did.

As far as possible I have tried to stick to facts from solid sources. However, I haven’t the slightest doubt that some of the entries will be argued over. That’s inevitable; but then, after all, history is ‘the never ending argument.’

One final point: I wish that I had had a book like this when I first started leading battlefield tours. It would have made my life so much easier.

Table of contents

- The Ancient World

- The Man on Horseback

- Fortifications

- Artillery

- Engineers

- Land

- Naval

- Airpower

- Battles and Campaigns

- World War I

- World War II

- Weapons

- New Weapons: New Wars?

- Intelligence

- Logistics

- Prisoners of War

- Warriors:

- Spartans

- Knights Templar and the Orders

- Janissaries

- Mamelukes

- Cossacks

- Vikings

- French Foreign Legion

- SS

- Plains Indians

- Ghurkas

- Samurai/Ninja

- Zulus

- Kamikaze

- Special Forces

- Marines

- The Exotic East – India, Japan and China.

- Those Other Things:

- Courage, Cowardice, Pacifism

- Disease, Casualties and Death

- Victory and Defeat

- The Media

- The Dark Side of War

- Who Said That? Selected Quotations

- The Weird and Wonderful: Military Eccentrics

- Trivia, Curiosities and Medals

Sample factoids

Chapter 1: The Ancient World

War: a universal fact

Watching indigenous tribesmen in places like Borneo we can be pretty sure that Stone Age men fought each other for territory, women and food, brandishing stone clubs and spears made of sharpened wood. Although we have no record, there is little doubt that different tribes have made war on each other from the dawn of time. Nowadays the battles of Brazil’s Yanomamö and Borneo’s Maring tribes are living examples of the fact that war between humans is ‘a timeless universal activity’.

When anthropologists pose the question, ‘Why does mankind fight?’ one standard answer is, ‘Because it can.’ Even aggressive chimpanzees and peaceful gorillas fight bloody battles for food, territory and females. Some of the anthropologists even claim that war is merely the most extreme form of Darwinian competition, and therefore – in evolutionary terms – can be seen as a good thing. Hmm…

Chapter 2: The Man on Horseback

Definitions

The phrase ‘The man on horseback’ is generally taken to have two clear meanings: literally, the warrior on his horse; but also, figuratively, to mean the involvement of the military in politics, after Samuel Finer’s seminal book of that title: The Man on Horseback. This an image that has dominated war and societies for centuries – and for very sound reasons…. The man on horseback can be dangerous.

Advantages of cavalry

A mounted soldier has three big advantages over an infantryman on the ground: He’s big and powerful; he can move quickly from place to place; and, within a mass, he can be very frightening. Some idea of this can be gained from a close-up experience. Visitors to the Stibbert Collection of arms and armour in Florence rarely fail to be impressed by the life-sized cavalcade of armoured knights on horseback that dominates the main hall. Looking up at these menacing armed men looming above the close-in pedestrian observer, the visitor suddenly gets a taste of what it must have been like to be confronted up close with the grim reality of the armoured fighting man on horseback.

Chapter 4: Artillery

Origins

The word ‘artillery’ seems to come from Artillier – a ‘builder of war machines’ – according to the manuscript of Etienne Boileau on the Guilds of Craftsmen in France, written in 1268.

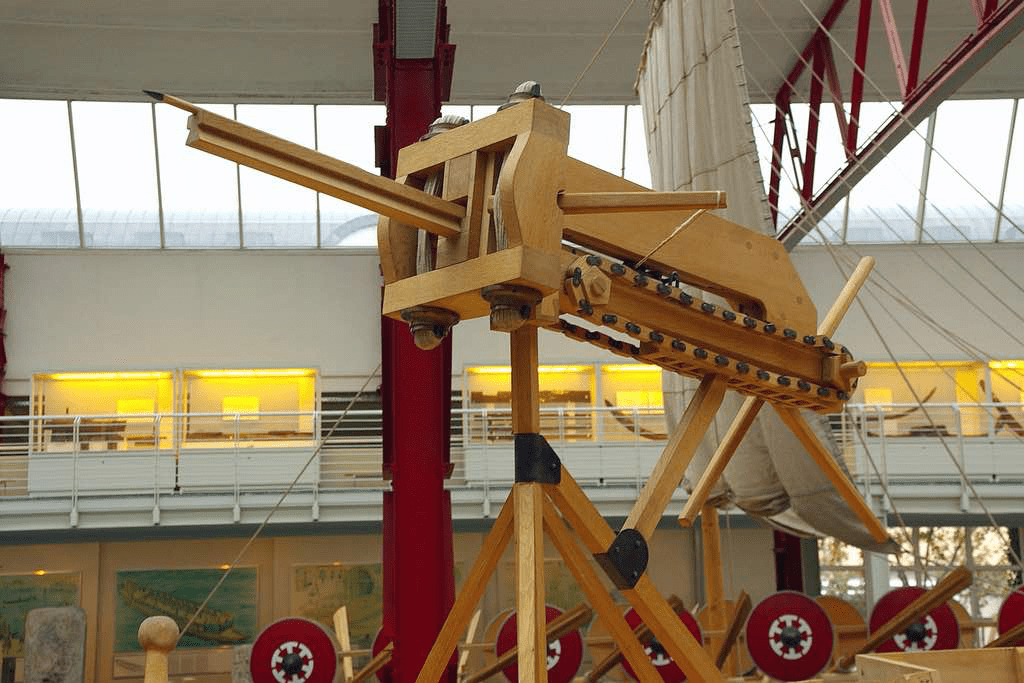

The first artillery was mechanical, not powered by chemical explosives. Long before gunpowder was known, soldiers used various methods of hurling projectiles at their targets. There were three main methods: the spring; the twisted cord; and the counterweight or lever.

The Greeks used ‘arrow-shooting machines’ from the mid-fourth century BC onward. Aeneas Tacticus mentions their use in his treatise on siegecraft written around 350 BC, and Athens’ Arsenal is recorded as having a number of catapults in store capable of shooting bolts of varying size by using animal sinews as springs.

Ballista-type catapults were basically huge crew-served crossbows that could fire heavy metal arrows or darts at a flat trajectory (and with considerable accuracy) against their targets. This is the origin of the modern word ‘ballistic’.

The Romans started to use catapults by the 3rd century BC and even mounted ballista catapults on their warships

Chapter 5: Engineers

Mottos

Quo Fas et Floria Ducunt (Where Duty and Glory Lead) – motto of the British Royal Engineers

Essayons! (Let’s try) – motto of the US Army Corps of Engineers

A brief history

The word ‘engineer’ comes orignially from the Latin ingeniarius or ingeniator, the name given to the military engineers who constructed roads, camps and siege equipment for the Roman Army.

In 1078 William the Conqueror employed a monk called Gundolf of Bec to build the White Tower in the Tower of London, describing him as ‘competent and skilled at building in stone.’ Gundolf took the title of ‘King’s Engineer’ from Waldivius, who had pre-fabricated forts for the Norman invasion as depicted on the Bayeaux Tapestry.

By about 1325, the French engine’er – meaning, ‘one who operates an engine’ – was used to describe the builders and operators of military machines such as mangonels, catapults, etc.

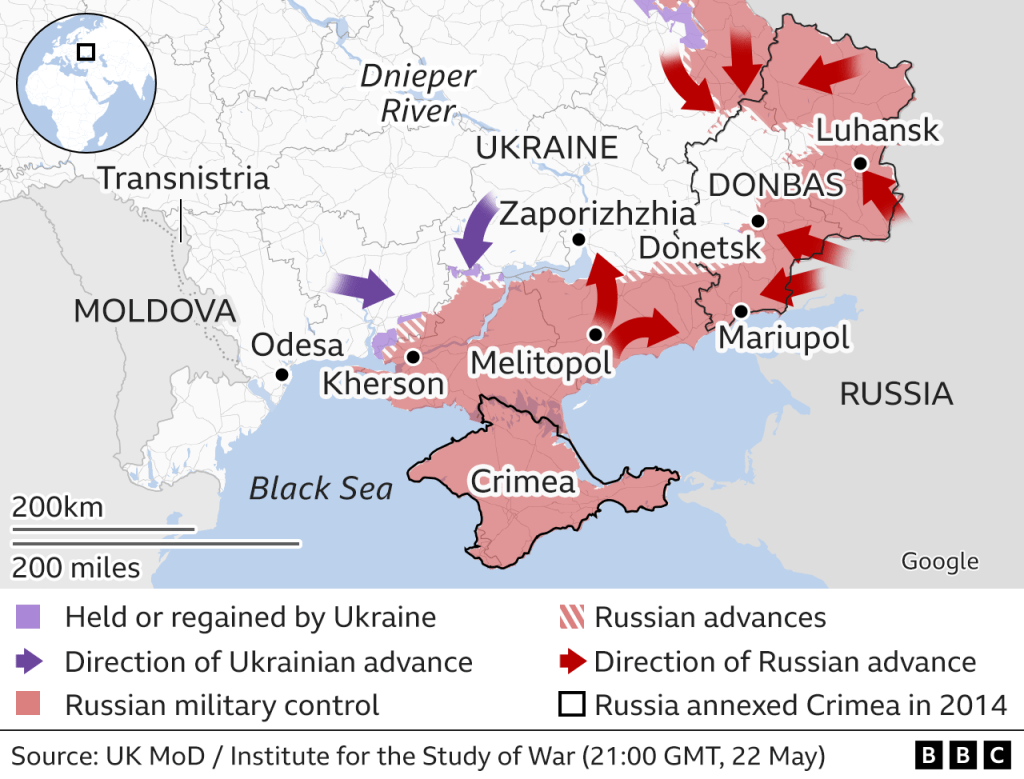

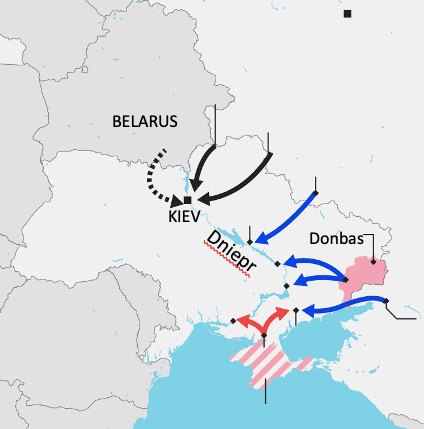

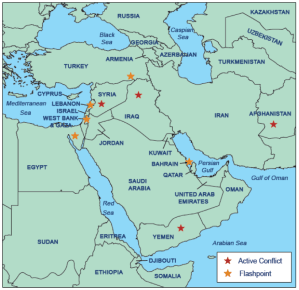

Well, it’s already started. The many wars in Syria, Lebanon, Iraq, Iran are beginning to come together into one single, bigger conflict. We are on the road to another war.

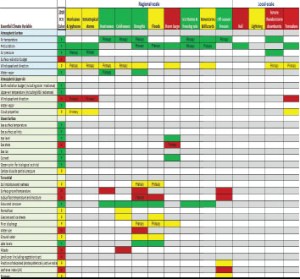

Well, it’s already started. The many wars in Syria, Lebanon, Iraq, Iran are beginning to come together into one single, bigger conflict. We are on the road to another war. Intelligence officers use a system called an ‘Indicators and Warnings board’ to monitor events and assess where they are heading. Essentially it is a list of key questions, listing the critical information requirements. Examples might be:

Intelligence officers use a system called an ‘Indicators and Warnings board’ to monitor events and assess where they are heading. Essentially it is a list of key questions, listing the critical information requirements. Examples might be:

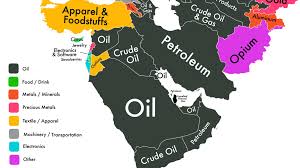

The USA has been willing to use its firepower in the past. It escorted ships here during the 1980s ‘Tanker War’. America fought its last naval battle in these waters against Iran in 1988. In July that year, the warship USS Vincennes even shot down an Iranian airliner, killing all 290 aboard, in what Washington said was an accident. Tehran said it was a deliberate attack.

The USA has been willing to use its firepower in the past. It escorted ships here during the 1980s ‘Tanker War’. America fought its last naval battle in these waters against Iran in 1988. In July that year, the warship USS Vincennes even shot down an Iranian airliner, killing all 290 aboard, in what Washington said was an accident. Tehran said it was a deliberate attack. If this were not bad enough, everywhere you look in the Middle East there are many other dangerous flashpoints, many of them already the scene of fierce fighting. In Yemen, Sunni fights Shi’a (Saudi versus Iran), as the Houthis become part of Iran’s regional proxy warriors. On the Syrian border, Turkey is already busy fighting the Kurds. Gaza and the West Bank still simmer with anti-Israeli anger. Israel has already mobilised some reservists as a cornered Netanyahu looks for a grand gesture – probably a demonstration of Israel’s military might – to help him form a government after the recent elections.

If this were not bad enough, everywhere you look in the Middle East there are many other dangerous flashpoints, many of them already the scene of fierce fighting. In Yemen, Sunni fights Shi’a (Saudi versus Iran), as the Houthis become part of Iran’s regional proxy warriors. On the Syrian border, Turkey is already busy fighting the Kurds. Gaza and the West Bank still simmer with anti-Israeli anger. Israel has already mobilised some reservists as a cornered Netanyahu looks for a grand gesture – probably a demonstration of Israel’s military might – to help him form a government after the recent elections.